carried interest tax loophole

If it were theyd be taxed at the ordinary income tax rate of up to 37. The carried interest loophole is a stain on the tax code Ackman said in a tweet.

Tax Reform Carried Interest Is Not A Loophole National Review

The 2017 tax law passed by Republicans largely left the treatment of carried interest intact following an intense business lobbying campaign but did narrow the exemption by requiring private.

. Obama pledged to do away with it but failed. Under the tax code this isnt considered part of their compensation. And these folks make a lot of money.

Typically the richest of the rich pay 40 percent tax on their. In Washington the villain is the carried-interest deduction a notorious loophole in the US. The carried interest loophole has been a target of many presidents.

It does not help small businesses pension funds other investors in hedge funds or private equity and. Tips on Taxes Capital gains come in two flavors. The carried interest tax loophole is a way that wealthy Americans often the people who manage hedge funds or private equity firms avoid paying billions of dollars worth of taxes.

And while the carried interest provision was nixed Schumer said Democrats added in an excise tax on stock buybacks that will bring in 74 billion. The 2017 tax law passed by Republicans largely left the treatment of carried interest intact after an intense business lobbying campaign but did narrow the exemption by requiring private equity. The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the amount they pay in taxes.

Wealthy investors including Warren Buffett and Bill Ackman have lambasted the tax treatment of carried interest. Its part of a bigger story about a tax code riddled with loopholes. Carried-interest income is what private-equity and hedge-fund players make when their investments are sold at a profit.

But a plan to close a big tax loophole is out. The carried interest loophole is a stain on the tax code he wrote in one post. It does not help small businesses pension funds other investors in hedge funds or private equity and everyone.

Sinema backed the bill after the removal of a provision to narrow the so-called carried interest loophole a tax benefit that both Biden and Trump opposed. Thats more than 25 million each. The provision is unpopular yet it has survived many attempts to.

Others argue that it is consistent with the tax treatment of other. The carried interest loophole was central to the debate over the Inflation Reduction Act signed by President Biden this week. Obama pledged to do away with it but failed.

Tax code that allows some of the wealthiest people in the country the managers of private-equity. Some view this tax preference as an unfair market-distorting loophole. The top marginal federal income tax rate is currently 37 percent yet thanks to the carried interest loophole the income that private equity and venture capital managers get from their clients is.

The Wall Street Journal says the 28 top executives of five big private equity firms shared 760 million in carried interest. The carried interest loophole allows hedge fund managers to tax their income at a lower rate than an ordinary salary. Schumer told reporters that he pushed hard to close the carried interest tax loophole which allows asset managers to pay a lower effective income tax rate than many middle-income Americans but.

Why does Sinema like the carried interest loophole. Carried interest or carry in finance is a share of the profits of an investment paid to the investment manager specifically in alternative investments private equity and hedge fundsIt is a performance fee rewarding the manager for enhancing performance. Carried interest is a loophole in the United States tax code that has stood out for its egregious unfairness and stunning longevity.

Since these fees are generally not taxed as normal income some believe that the structure unfairly takes advantage. Last night Senator Kyrsten Sinema Democrat of Arizona announced her support for. Only an elite few are eligible for the notorious carried interest loophole which allows private equity and hedge fund moguls to pay a capital gains rate of 20 percent on some of their income rather than the typical 37 percent tax rate for top earners.

Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation. Carried interest or carry is a share of any profits that the general partners of private equity and hedge funds receive as compensation regardless of whether or not they contributed any initial. Joe Manchin D-WVa said Thursday he is standing firm on keeping a proposal to close the so-called carried interest tax loophole in the tax and climate deal he reached this week despite pot.

The carried interest loophole allows private equity barons to claim large parts of their compensation for services as. This income is taxed as a long-term capital gain at a lower rate than. Donald Trump did the same but was.

He said that multiple legislators are excited. The carried interest loophole is a stain on the tax code Ackman the chief. In contrast with regular investors only general partners the firms top executives.

Under the carried interest loophole this income is taxed at the capital gains tax rate rather than the higher earned income tax rate. Msn back to msn home news.

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

Mnuchin S Not So Grand Stand On The Carried Interest Loophole Explained Itep

Bill Ackman Slams Carried Interest Loophole As Democrats Take Aim At Tax Rule

Treasury To Issue Carried Interest Regulations Closing Perceived S Corporation Loophole Butler Snow

Bill Ackman Slams Carried Interest Loophole As Democrats Take Aim At Tax Rule

Carried Interest In Private Equity Calculations Top Examples Accounting

Judd Legum On Twitter Congrats To Senatorsinema For Preserving The Tax Loophole For Hedge Fund Managers A True Champion Of The People Twitter

Schumer Defends Dropping Carried Interest Tax Change To Win Over Sinema The Hill

Bill Ackman Slams Carried Interest Loophole As Democrats Take Aim At Tax Rule

What Would The New Carried Interest Loophole Proposal Do New York Daily Paper

Senate Passes Sweeping Climate Health And Tax Package Putting Democrats On Cusp Of Historic Win

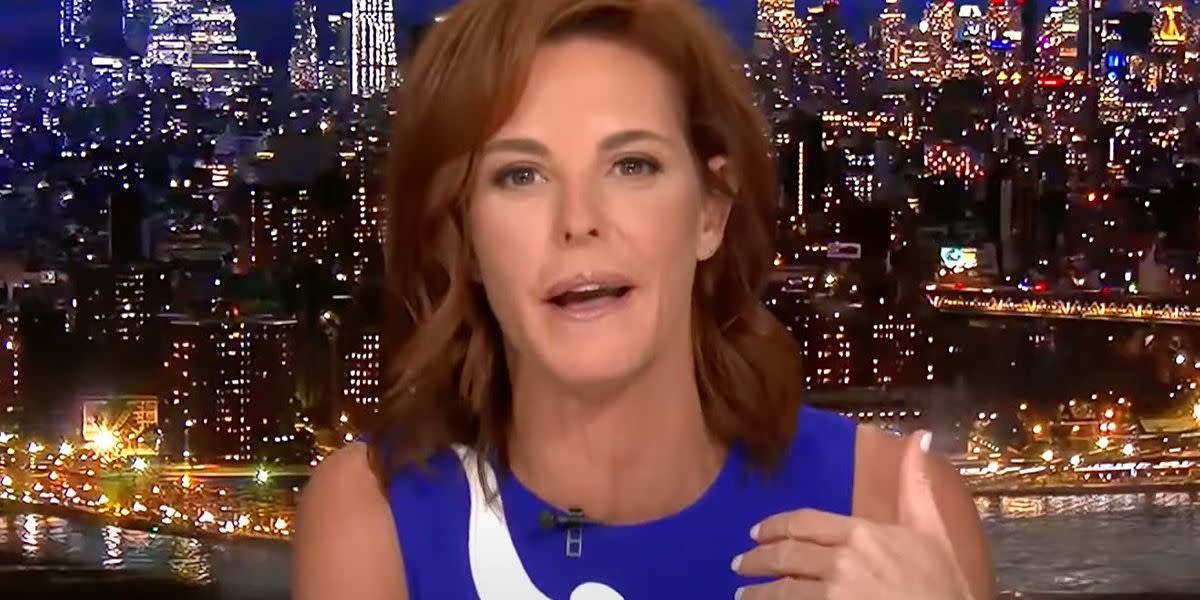

Msnbc Host Succinctly Nails Problem With America S Most Outrageous Tax Loophole Huffpost Latest News

Bill Ackman Slams Carried Interest Loophole As Democrats Take Aim At Tax Rule

Joe Manchin Says Climate Bill Closes Loopholes But Does Not Raise Taxes Financial Times

Hillary Clinton Vows To End Carried Interest Loophole Even If Congress Won T Vox

Msnbc Host Succinctly Nails Problem With America S Most Outrageous Tax Loophole

Sen Kyrsten Sinema Agreed To The Inflation Reduction Act But Cut The Carried Interest Tax Provision Here S What That Means For Wealthy Investors

The Commander In Chief Has Again Voiced His Displeasure With The Carried Interest Tax Provision Which Allows Many Pe Inv Philip Iv Of France White House Tours